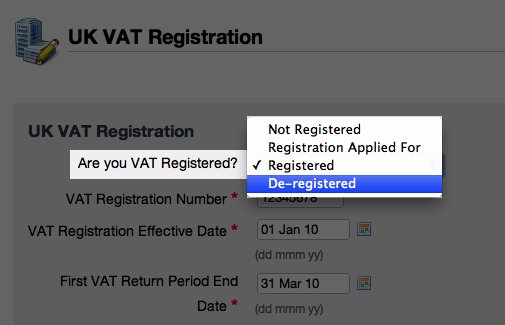

Deregistering for VAT

Trading just below the VAT threshold of £85K and thinking of deregistering? It’s very simple to do. But do think about the implications before you go ahead.

Profit and Prices - You need to think about how your sales prices have been calculated prior to deregistering. If you have calculated your sales price with purchased items that you pay VAT on, your margins may well drop. It might seem a good idea to instantly increase your profit by 20% by retaining the same gross sales price to your clients but what happens when they discover they cannot claim back their VAT which may then lead to unintended perceptions.

Perception – If you registered for VAT when you first set up to give credibility, is that still relevant? Some businesses have rules about who they can do business with and as well as being a limited entity, being VAT registered might also be mandatory.

Pitfalls – you should also take into consideration the timing of a de-registration. If you have just claimed back VAT on large ticket items like vehicles, machinery or stock then choose to deregister, HMRC will come knocking on the door.

We would say, it’s a simple process to undertake, but do chat with your accountant before you choose that path and don’t risk regretting the decision.