Digital Services and the New VAT Rules

From 1 January 2015, businesses selling or providing digital services directly to the consumer such as broadcasting, telecommunications and e‐services will have to declare and account for VAT in the country where the customer is based. The digital supplies will be taxed at the VAT rate in the consumer’s member state.

A good rule intended to clamp down on the internet giants such as Amazon but with consequences for SMEs that were possibly not anticipated.

First of all do be clear that your business supply these digital services? ‘Digital services’ include:

-

broadcasting ‐ the supply of television or radio programs

-

telecommunications ‐ fixed and mobile telephony, fax and connection to the internet

-

e‐services ‐ video on demand, downloaded applications (or ‘apps’), music downloads, gaming, e‐books, anti‐virus software and online auctions

But it does not for example include:

-

Using the internet to sell tickets for an event

-

If you use a platform such as Amazon to sell your products – they then are responsible.

But before you panic read on…..

If your business supplies digital services to consumers (B2C), it is you supplying the services that are liable to pay the VAT to the tax authorities.

-

If you are UK VAT registered, and are making B2C digital service supplies to customers in other EU Member States, you can register for the VAT Mini One Stop Shop (MOSS).

MOSS will enable you to register just once (in the UK) and submit a single MOSS VAT return and payment each quarter for all your cross‐border supplies of digital services. If you register for MOSS to account for the VAT on all your EU cross‐border supplies, you can use the European Commission's EU VAT Web Portal to determine the VAT information (e.g. VAT Rates, VAT Invoicing requirements) in each Member State.

-

If you are not UK VAT registered, and you are not using a digital platform, store or marketplace to supply digital services, then you will need to:

• Register for VAT in each Member State that you supply digital services, or

• Voluntarily register for VAT in the UK and then use the MOSS

Provided a business organises and operates its cross‐border digital services business entirely separately from its UK domestic business, we understand that HMRC will allow that business to register for VAT so that it can then register to use MOSS but will not have to pay UK VAT.

-

You will need to determine if your customers are 'taxable persons' who are in business and have provided you with their VAT Registration Number (VRN), or other information that they are in business, because if this is the case, you will be making business‐to‐business (B2B) supplies which will be dealt with under existing EU VAT rules, rather than B2C supplies.

If you do decide to register and use MOSS to account for the VAT on your supplies to customers in other Member States you will need to:

-

Submit MOSS VAT returns on a calendar quarterly basis, including ‘nil’ returns if you do not make any digital service supplies; be able to determine where a customer is located in order to determine the VAT rate that applies and to complete the MOSS Return, by for example obtaining information such as the customer’s billing address, IP address or telephone number.

More information: VAT on digital services in the EU https://www.gov.uk/vat‐on‐digital‐services‐in‐the‐eu

Register for the VAT Mini One Stop Shop https://www.gov.uk/register‐and‐use‐the‐vat‐mini‐one‐stop‐shop

Guidance on supplying digital services and the VAT Mini One Stop Shop

Latest announcements from HMRC on CJRS Dec 2021

Latest updates from HMRC on Coronoavirus Job Retention Scheme with extension to 30 April 2021 announced

15 ways Brexit will impact businesses based in the UK

31 December 2020 marks the end of the Brexit transition period. Here's what we know so far regards business

Business Mileage 2020 and what you should claim

As all business owners know, business mileage can be reclaimed: but the rates applicable do vary, depending on who owns the car being used – you or your employer.

Update on CRJS as at Nov 2020

The government has now published its official guidance for the Coronavirus Job Retention Scheme, which has been extended until 31 March 2021.

Choosing a company vehicle

Choosing the right vehicle(s) and the right finance options for your business is an important decision: get it wrong and it is potentially costly. Get it right and you can save a lot of money, time and hassle – so give it careful consideration.

Update as of 5 Nov 2020 on Furlough and Job Retention Scheme

Please note this is correct at time of publishing but keep an eye out for updates as they happen.

The further extension of furlough

Funding support for employees – the latest instalment

It seems we’ve only just published our report on the new Job Support Scheme (JSS) and already it has been superseded by events.

JSS and Lockdown Restrictions

Will the new Job Support Scheme cover me if my business is closed due to lockdown restrictions?

Support versus retention – what’s the difference?

The Job Support Scheme replaces the government’s Job Retention Scheme on 1 November; but what precisely is the difference? A fair question, which impacts tens of thousands of employees across the country: so let’s look at the detail.

October Update on Job Support Scheme and Self Employed Support Scheme

The Chancellor has announced the bones of the new scheme which will replace the Coronavirus Job Retention Scheme, or 'furlough scheme' which is due to end at the end of this month.

What you need to do from 1 October

From 1 October, HMRC will pay 60% of usual wages up to a cap of £1,875 per month for the hours furloughed employees do not work.

Get your Business Real Estate correct

Your business Real Estate is your business name and all that goes with that. It's important to make the right decisions

Are you at risk of a SEISS penalty?

If you are self-employed or in a partnership then you probably used the Self Employed Income Support Scheme (SEISS) in recent months but did you make a mistake with the claim?

Check out these complicated rules for VAT and electrical charging installations

There are more than 33,000 charging points for electric vehicles across the UK and you may get asked to install one

From 1 September HMRC will now pay 70% of usual wages

Update about changes to the Coronavirus Job Retention Scheme (CJRS) which came into force 1st September and what this means for you.

Understanding SSP and Quarantine Rules

What are the rules for Statutory Sick Pay when an employee is obliged to self isolate after travelling abroad?

How to get to know your customers and make sales.

We’ve all heard the saying “People BUY from People” which really means that we buy generally from people and businesses we like and trust.

Eat out to help out explained

Rishi Sunak is hoping his scheme will help out many restaurants and café’s over the month of August,

What's new with the CJRS from August 2020

Details about the Job Retention Bonus and changes to the scheme as of August 1st 2020

6 inexpensive ideas to promote your business successfully

When you have a small business you are most likely also responsible for promoting your business. Here are some almost cost-free ideas to use

Post lockdown, what is the tax position on insurance claims for Business Interruption?

If you had the foresight to include a Business Interruption clause in your corporate insurance policy then you will no doubt have been in touch with your insurer now lockdown has lifted.

Each year HMRC conduct random checks on a small number of companies

Each year HMRC conduct random checks on a small number of companies that submit returns that include transactions under the Construction Industry Scheme (CIS).

Marketing Tip for small businesses that does not require social media.

For some businesses, social media is either too daunting or not quite right to engage with clients. Read on for some practical tips on something to do instead.

Flexible Furlough and what you need to know

Here are the rules employers and employees need to know to access the government’s flexible furlough scheme that launched on 1 July.

A brief summary of Funding and Grants available to help your business through the pandemic

We would suggest checking back at this page on a regular basis though as updates seem to come daily if not weekly. And some have deadlines coming soon.

The future of commercial fleets

The future of commercial fleets from the MArch 2020 Budget is still good advice, regardless of when you are reading this blog.

Building or renovating your home: what’s the position with VAT?

Whether or not you need to pay VAT when building or renovating your home can make or break a project; after all VAT at the standard rate will add 20% to the cost.

VAT and Company Vans

What does the VAT-man say if you are trying to drive a financial bargain for your next company van?

Pricing to the bottom – not a good marketing strategy in recessions.

Before you think about slashing any prices in an effort to win customers, have you thought it through and what else could you do?

CJRS Update May 29

More details about the extension of the Coronavirus Job Retention Scheme (CJRS) and the Self-Employment Income Support Scheme,

A recession is looming - now is the time to act

Once lockdown is over and business starts up again there are strong indicators that we are heading into recession and a long one at that. As a small business owner, you will be forced to make drastic moves to survive. Here are some tips on how to survive.

Zero Hours and Furlough

If you have any zero hours employees or are, indeed, one then the following should answers some of the commonly asked questions

What to do if your biggest customer goes bust - updated for May 2020

Looking ahead to post lockdown and as businesses try to pick up the pieces there will be casualties. What if one of those casualties is your big name client which you were so pleased about before the world went Covid-19 mad?

The coronavirus Statutory Sick Pay Rebate Scheme launches online on 26 May.

The scheme will enable employers with fewer than 250 employees to claim coronavirus-related Statutory Sick Pay (SSP). Tax agents will be able to make claims on behalf of employers.

Update on the Job Retention Scheme - May 2020

Last week it was announced that the CJRS scheme will be extended until the end of October. The scheme will continue in its current form until the end of July.

Commercial Rents and help for Tenants during the Pandemic

High street shops and other companies under strain can be protected from aggressive rent collection

More help for small businesses during the coronavirus pandemic announced

The Chancellor has announced a 100% government backed loan scheme for small businesses, designed to offer up to £50,000 of fast-track finance for those affected by coronavirus

What happens if one of the years for the scheme made a loss

The self employed income grant scheme is not yet available online but here is a question we have been asked about how HMRC will calculate the grant if one of the qualifying years actually made a loss.

Covid-19 more business funding announced

Scottish Government second phase of funding to protect businesses against the effects of COVID-19.

How to make a Job Retention Scheme claim

HMRC have now released information for employers about making a claim for The Job Retention Scheme.

Job Retention Scheme

More detailed information on the Coronavirus Job Retention Scheme and how it will work including updates as they are released

3 new funds for the creative community in Scotland announced.

Funding programmes designed to provide further support to sustain the country’s creative community during the COVID-19 outbreak:

Covid 19 Limited Company Directors and Dividends

Self Employed or Limited Company Director with Dividends - we try to unravel what support is available

Self-employed workers - Covid-19 support

The scheme to help self-employed workers who have been hit by the COVID-19 crisis has finally been announced

VAT Deferral - Covid-19

We are getting asked a lot about VAT and deferral as announced by The Chancellor. Important information if you want to take this action

Coping for business during the Covid-19 Crisis

This excellent Business Action and Advice plan has been published by Business Gateway. It’s not too late to implement some of the suggested strategies and some good ideas for moving forward. As always, we are here to help you too.

More about accessing the Business Support Fund

Grant support is now available to help business deal with the impact of COVID-19. The purpose of these one-off grants is to help protect jobs, prevent business closure and promote economic recovery

Keep in in touch with your customers now will pay dividends after the crisis

Some advice about using Digital Tools and Social Platforms during the Covid-19 Crisis

CV-19 Employers Update

We offer some advice for employers regarding self-isolation as of today but this may change and we will keep you updated.

CV-19 affects Landlords - what the government expects

The Scottish Government issued a statement about Rented Accommodation. We have extracted from the statement information relevant to private landlords.

IR35 and the implications

HMRC will apply new rules on IR35 from 6 April 2020, much to the disappointment of those who have campaigned to halt the change.

IR 35

Much has already been done to improve the administration of IR35 and there is more to do on many of the areas identified for improvement.

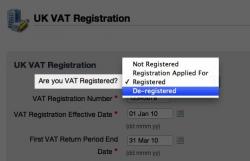

Deregistering for VAT

Trading just below the VAT threshold of £85K and thinking of deregistering? It’s very simple to do. But do think about the implications before you go ahead.

If you thought the age of apprenticeships was over, think again

Modern Apprenticeships are in the news quite a bit at the moment with the Scottish Government looking to fill the skills gap. Here's some information in case your business might think about an apprentice

The battle between cyber criminals and companies is constant and on-going

Business is now done mostly on personal computers, smartphones and tablets so we often take the advantages of this flexibility somewhat for granted. It is too easy to forget that each of these devices may represent a risk to the company and to its data.

Business mileage payments for electric and hybrid vehicles.

With the number of electric cars in the UK now exceeding 155K and interestingly over 5K vans, business use and how to work out mileage reimbursements now can present a considerable problem.

Employing Children, Save Tax and keep them busy this summer

I’m bored - the eternal summer cry from the kids

Here’s the answer - employ them and save on tax at the same time

Paying salaries to your children is a good way to reduce your taxable profits but how should you do it legally?

Company Vehicles - choose wisely

Choosing the right vehicle(s) and the right finance options for your business is an important decision and a costly one if got wrong.

What can you and should you be claiming for business expenses

Just what can you and should you be claiming for business expenses. This is one of the most frequent questions that an accountant is asked.

How to access £9 billion public sector spending with SDP

The Supplier Development Programme supports businesses competing for the £9 billion annual spend of the Scottish public sector.

A new business can struggle to get the pricing right - we offer some simple tips

This is something, as Accountants, we come across time and time again. It’s often the reason for early business failure and it’s completely avoidable. Here are some simple tips.

Find out if your suppliers are still performing as well as you want them to

We found this good article courtesy of bluqube who offer accountancy software and thought you might find it interesting.

5 ways businesses will benefit from a Brexit VAT health check

When the UK leaves the EU, the cross-border VAT environment for businesses will change.

Performing a VAT health check now will highlight practical measures that businesses can take to ease the transition and minimise risk

Business Loans Scotland provides gap funding to businesses that are looking to grow but need external finance to make it happen.

Does your business need funding to grow? Are you struggling to secure finance from the traditional lenders? Business Loans Scotland may be able to help.

Minimum Wage Shame

HM Revenue & Customs (HMRC) has recently named 70 offenders who have failed to pay the National Minimum Wage (NMW).

Facebook makes it easy to compete in the marketing stakes

We came across this article on The Drum and thought it really insightful as to how small business can easily compete with large corporates on Social Media. There is a raft of tools available now to help small business create compelling ads for little or no cost and reach ‘000’s for much less than the tiniest ad in the local press. Read on…

When Referrals go wrong

When a client refers you on for business, that’s great isn’t it? Well maybe, but read on for some potential pitfalls and how to solve them

7 ideas on how to cover self employed illness and inability to work

With all the recent furore over the “White Van Man” NI contributions rising then scrapped in the Spring Budget, we thought we’d have a look at what happens when a self employed business owner falls ill and can’t work.

Auto enrolment and the self employed or sole trader.

It's a risky strategy NOT to plan ahead for retirement when self employed. But many self employed are already struggling to keep heads above water without finding extra funds for pensions

Information from HMRC on Making Tax Digital

Businesses should not have to wait until the end of the tax year or even longer before knowing how much tax they should pay.

From April 2018, businesses, including everyone who is self-employed and those letting out property, will update HMRC at least quarterly

VAT Explained Part 3 - International VAT

Did you know that VAT is recoverable in more than 40 countries around the world?

For companies who have employees that travel to any of those countries, there is a percentage of tax in many expense types that can be reclaimed when business travellers return to their home country.

VAT Explained Part 2 - Fuel and Mileage

There are four ways to reclaim VAT paid on fuel for business trips:

VAT Explained Part 1 - Taxes made clear

VAT was introduced to the UK over 40 years ago on the 1st of April 1973. It was supposed to be straightforward and simple. Yet many years later, some of the rules can still leave you scratching your head – and they’re changing all the time

Business Rates - do not be caught out and check it now

The 2017 Business Rates revaluation is under way. This happens about every 5 years normally and should have been in 2015 but was postponed till 2017.

When HMRC audit a business they look at the entire travel and expenses process

Most people assume HMRC inspectors are only interested in completed expense claims and associated receipts – but they’re not. When the time comes to audit your business, HMRC will be looking at your entire travel and expense

Company Car changes

It has recently been announced that HMRC has started an online trial that will allow company car drivers to alter their company car details online. This is a very good idea in principle but without the correct framework it could be fraught with trouble

Intellectual Property - protect your ideas and innovations before someone else steals it.

When a business starts up often the last thing on the entrepreneurs mind is Intellectual Property.

Keeping your finger on the Digital Pulse might save your business '000's

With Cyber Crime costing SME's over £18 billion, it pays to keep up to date

4 Ways Cyber Crime Can Hurt Your Small Business.

We found this excellent article on Business Know How. It is something that many small businesses still overlook until it is too late – here are 4 consequences. And here is a link to the National Cyber Crime Unit for excellent advice

Business Awards bring success so just do it

Business Awards are without a doubt a great way to increase your business profile. Read on for 5 Top Tips on how to make your entry a winner

Working from home. How do you calculate a tax claim for heating and lighting?

Do you work from home and use the same rooms for personal use as well? Here’s how to work out a tax claim for heating and lighting.

Regain control of business costs

Shrewd owners minimise their spending when starting their business. It makes it easier to turn a profit and limits losses should the business fail. In the early days, they continue to control costs in all areas. But, gradually, things can change ....

Persons with Significant Control changes - does this affect you and if so, what you should be doing

From April 2016, UK companies and Limited Liability Partnerships are required to keep a register of Persons with significant control (PSC).

10 Practical Tips for small business to reduce the tax bill

It’s never a wrong time to review your company set up and ongoing strategy. Here are 10 Top Tips to help you possibly reduce your tax and accountants bill.

When is a hobby actually a business? What you think and what the taxman thinks might be quite different. Read on...

You might think that selling second-hand items and crafts online is a hobby, but the taxman will class you as a business if it can prove you are doing “anything in the nature of trade”.

Keeping an eye on employee expenses can vastly improve the company bottom line

Business owners know they need to maintain a mobile workforce. But at the same time, “out of sight” needn’t mean “out of mind” as a new generation of payments services are using data to enable employers to keep tabs on those on the road.

RTI and Micro Businesses. You can now be fined for late submissions

HMRC has updated its guidance on what happens when employers fail to report their business’s payroll information on time. Here’s what you need to know:

Seven ways the cloud can help you manage your business

If you’re a start-up, making use of the cloud can be a no brainer, but for more established businesses, the advantages of heading off-site may be harder to quantify.

Owing Property personally or through a limited company: what is best?

The majority of investors have tended to own their property portfolio in personal names because it’s beneficial for them to do so when it comes to selling the property.

Funding for your Business R&D. There is funding out there for businesses to help with R&D

There is funding out there for businesses to help with R&D. Below are some of the government run opportunities and this link will give you much more information.

CIS returns must be submitted online from April 2016, sub- contractor verifications to be done online from April 2017 and there are also changes to those who can be paid gross

2016 Employment Law Updates

A useful snapshot of the latest employment updates. The changes to National Living Wage are undoubtedly having an impact on many small businesses.

No Dodges for Contractors

There aren’t any ‘dodges’ for Contractors with the new Finance Bill legislation.

Setting up your contractor company - Limited, Umbrella or PAYE?

This is the first in our series of articles to help Contractors get started and run an efficient company.

Setting up your contractor company - Limited, Umbrella or PAYE?

Setting up your Company

Travel and Subsistence Legislation Update

The long awaited travel and subsistence legislation has finally been published in full in the Finance Bill 2016.

Bereavement Pay and Leave

It’s always a difficult time when someone passes away and as a good employer, you want to do the ‘right thing’. But there is still the smooth running of your business to consider, especially for smaller companies.

Illegal Workers could cost you £20K each

With the summer months just around the corner, many small businesses may well be looking to augment staff with temporary employees and there is a good chance they may come from overseas. But how robust are your pre-employment checks to ensure you don’t employ and illegal immigrant? And how can you avoid being accused of racism at the same time.

Trading Losses not always a disaster

If you are coming to the end of your business financial year and it looks like you have made a loss, there are options that you and your accountant should look at to minimise the impact

Pensions and Tax Year End

If you are thinking about making a pension contribution before the end of the tax year read on to find out about current limits

Zero Hour Contracts avoid getting caught out

The hospitality industry is one of the most prolific users of Zero Hour Contracts. But not all employers are using them correctly.

Minimum Wage - the clock is ticking

The Living Wage along with Auto Enrolment, are the legislation changes that are really making a financial impact on employers this year. Yet amazingly there are still business owners that are not preparing for the changes or don’t know anything about them.

Mandatory online filing of CIS returns and verifications

Over 85% of contractors and their authorised agents are already sending their CIS returns online, but from April 2016 everyone will have to use the online service. HMRC will no longer be accepting any paper forms from that date.

10 Worst Tax Deadline Excuses

The ten worst excuses for missing the 31 January Self Assessment deadline for 2013 to 14 according to HMRC.

(We loved these - especially going to Italy for 5 years!)

Apprentices - young 'uns for hire

You be giving thought to taking on an apprentice. Government continue to push apprenticeships and there are a myriad of support mechanisms in your local area to help you. But here is an overview to help you get started.

Annual Investment Allowance - plan ahead

Annual investment allowance (AIA) is a relief that can be claimed on the cost of plant and machinery. Up to 100% of the costs can be claimed to help reduce the potential tax liability for that business

R&D Tax Credits still alive and paying out

The Chancellor’s Autumn Statement made no changes at all with regard to R&D Tax Credits. Some had speculated that the relief might be reduced significantly

Tips, Gratuities and Tax

Here’s a very interesting point about tips and how to handle them. The way the tips are treated will depend on who receives them and who distributes them.

Christmas Gifts and Staff

If you decide to give your employees a cash bonus, this will be treated as taxable income and subject to tax and national insurance the same as other earnings.

Tax: a Sign of Success?

Remember you can only build wealth from ‘after tax’ income. A big payment to HMRC is not failure to hide the money; it’s a clear indicator of success....

The Scottish rate of Income Tax will come into effect from 6 April 2016.

On 2 December 2015, HMRC will start to contact customers living in Scotland where records show that this is their main address, to inform them they have been identified as being a Scottish taxpayer.

What you need to know.........

A Guide to Cloud Accounting

Cloud Accounting is clearly the way to go now for small businesses with the growth of good connectivity. Indeed, we would recommend new start businesses look at Cloud Accounting right from the start.

Book-keeping basics..... NOT top secret

Few people start a business so they can do paperwork. Spending time adding up receipts or pushing invoices around a desk is nobody’s idea of fun – unless you’re a book-keeper or accountant.

Auto Enrolment at a glance

If you simply need to familiarise yourself with automatic enrolment here is a brief outline

What is automatic enrolment?

In an effort to encourage more people to save for their retirement, the Government has introduced new rules which require employers, and most employees, to save into a pension scheme.

How to improve your company credit rating

If you are applying for funding from any sources – see our article on Funding Sources – it's vitally important that your credit rating is as good as possible and here are our tips to help.

Sources of Funding

In a recent article we talked about improving cashflow and feedback has been positive. But what if you need a cash injection into your business – for a variety of reasons? Gone are the days when it was a straightforward trip to the Bank Manager. Indeed SMEs are still finding it difficult to get the necessary finance to grow or support their businesses.

13 sure fire tips to improve your cashflow

It's a much overused cliché but cash really is king when you are running a small business. It does not matter how much money is coming into the business in the future if you don't have enough to keep you going. You have your own suppliers to pay, staff who expect wages every month, rent to pay and so on. Here are 13 sure fire ways to improve your cashflow:

What do you think is the important component of a client relationship? Is it:

- Regular communication?

- Sharing the same values?

- Having a strong personal connection?

We think these are all very important but we believe that the top component is TRUST.....

Choosing the right accountant - 7 Top Tips

Choosing the right accountant when starting in business, or indeed, when you realise it’s time to move on can be a daunting task....

7 Top Tax Breaks for Small Business

Many small businesses are failing to take advantage of the tax breaks that could provide enormous financial benefit to their business. In fact, a recent report suggests that a third are still unaware of the breaks available to apply for...

All Priory Clients are entered into our brand new annual Prize Draw. A welcome gift for you just at the time of year when you might need it most.

Buy to Let - Profit or Loss?

George Osborne wiped nearly 11pc off the gross returns from buy-to-let properties, leaving many landlords facing the prospect of an annual loss, when he slashed higher-rate relief on mortgages in the Budget.

Crackdown on Contract Workers

Contract workers and freelancers who set up companies to cut tax bills could be forced to justify their tax arrangements to their employers, thanks to a proposed new crackdown.

5 Top Tips when growing your business

Summer for many means holidays and time off to relax with family and friends. It’s also a time to ‘clear the head’ and start thinking about the business for the coming months.

Increase prices, increase profits - understand the effect of raising and lowering prices on profitability

How did you decide on your current pricing? Did you conduct market research to understand what prospects would pay? Or did you compare yourself to your competitors and base your price on that? Or was it a random shot in the dark? These are the ways most people do it, and they are all wrong. Because the price you set for your products and services is more important than you think.

Top Tips for Business Owners on holiday

If you plan to switch off completely – that means not even thinking about your business, then read no further and have a fabulous holiday. But did you know that 75% of business owners still beaver away during vacation time.

Home workers and getting the tax returns right

If you work from home you are entitled to include part of the running costs of your home in your accounts, which will save you some tax. This is of course, good but how do you calculate the right amounts. There are two potential methods for calculating this.

7 Top Questions to ask BEFORE you recruit a consultant

Top Questions to ask Consultancy or Coaching business before starting work with them

10 Top Reasons to Work from Home

Working from home is incredibly convenient. If you’re starting your business, it’s also the place you have already. It’s easy to start your business at home. Of course you need some space and there may be distractions, but there are lots of good reasons for working from home.

Are you a Landlord?

HMRC have now clarified that the Let Property Campaign is not coming to an end and will remain in place until further notice. The campaign allows landlords with undeclared rental income an opportunity to come forward with minimal penalties and set their record right.

HMRC taking it anyway

Accelerated payments were introduced by the Government in the Finance Act 2014.

Top Tips for Business Travellers

At Priory Accounting, we look after the accounting needs for many Consultants – indeed it is one of our areas of specialist expertise.

Priory Accounting is growing

We're now in Fife and Edinburgh and welcome our newest associate, George Lewis.

George is based at our new branch office in West Granton, Edinburgh and brings over 26 years of experience as an Accountant. 2015 certainly looks to be an exciting year for Priory Accounting but you can be sure that the one thing we won’t be losing sight of is the fact that almost 100% of our clients are still delighted with our services.

Renovating for Profit

Relief from capital gains tax on selling of the main residence has attracted a lot of HMRC attention in recent years

Late Payment Penalties

As the Self Assessment deadline has now passed; HMRC will begin to start issuing penalty notices to those clients who did not meet the legal requirement to file their returns on time

Creative Industries

“I don’t want distracted from my work and knowing Roddy and team are there covering my back allows me to get on with the work”

Some of our favourite clients work in the Creative Industries sector. Their feedback shows that what they value most is reliability when it comes to professional services.

Top Tips when claiming VAT back

If you find all the different VAT rates to consider a maze Roddy is here to guide you through.

Keep the Receipts

Our simple top tips to help you manage all those very important scraps of paper - especially when you're busy.

Don't be Last Minute.Com

Don’t leave it till the last minute to get your tax returns done.

If you are going to be due a payment to HMRC it makes sense to prepare your returns in good time so you can budget and manage your cash flow.